charitable gift annuity tax reporting

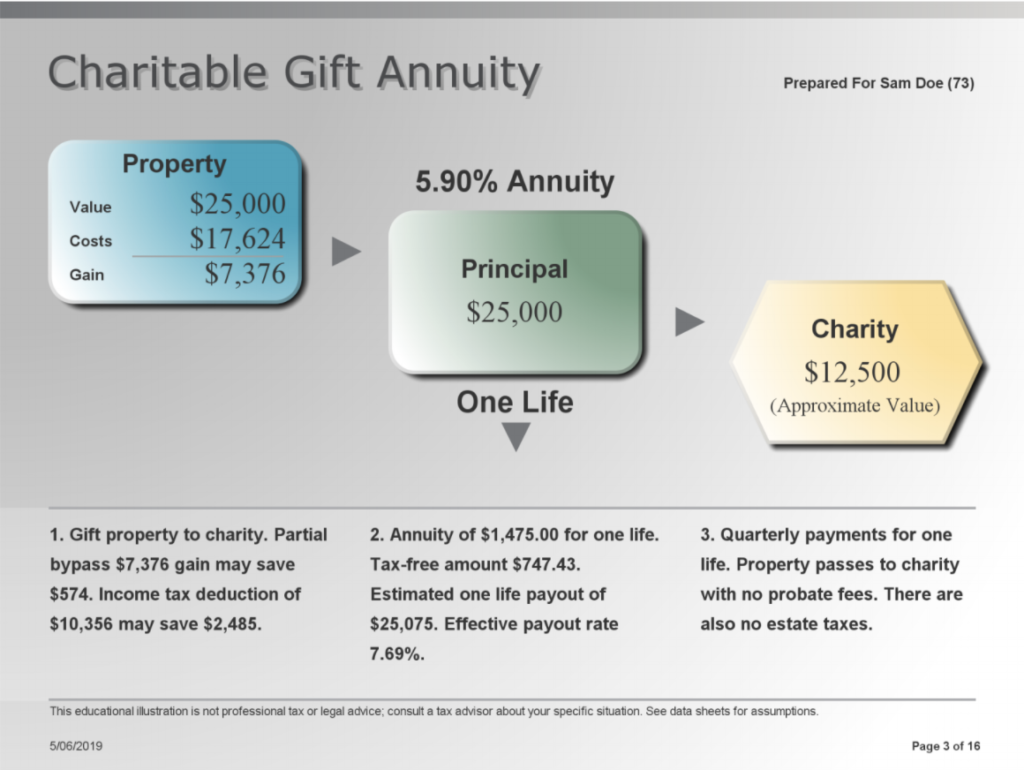

Charitable gift annuities are attractive because they allow you to make donations to the charity of your choice while also receiving a lifetime fixed income stream for yourself or others. Donors who fund an annuity with appreciated property must also report a certain amount of capital gain income.

How Do I Deduct A Gift Annuity To A Charity

Free Online Tax Filing w Americas Leader In Taxes.

. Ad Earn Lifetime Income Tax Savings. Get Your Max Refund With TurboTax. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios.

The income tax charitable deduction for a gift annuity is less than the amount of the gift donated. Click on Tax Tools from the menu on the left-hand side of the screen and then click on Tools. With a 18 discount.

However the donor must report the remainder gift regardless of size because its a future interest. Get Your Max Refund Today. They receive an annuity rate of 49 the American Council on Gift Annuities rate in May 2020 with annual annuity payments of 2450 50000 x 49.

Give Gain With CMC. Taxation of Annuities Funded with Cash If a donor makes a gift. Click on View Tax Summary.

The value of the charitable remainder interest is not subject to gift tax. Content updated daily for popular categories. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

A quick way to see that this requirement has. Learn how to maximize your impact with a Schwab Charitable donor-advised fund. That makes sense when you consider only part of the gift annuity is a gift to.

Later when you start receiving the annuity payments you will receive a 1099-R from. A contract that provides the donor a fixed income stream for life in exchange for a sizeable donation to a charity. In exchange for the gift contributions made to a charity the.

A charitable gift annuity is a contract between a donor and a charity with. Ad Looking for top results. If cash or capital gain property is donated in exchange for a charitable gift annuity report distributions from the annuity on Form 1099-R.

Fisher Investments warns retirees about annuities. A gift annuity offers immediate tax relief and has the potential to provide some tax-free retirement income. 282 holds that if a donor makes a gift to a charitable organization and in return receives an annuity from the charity payable for his or her lifetime from the general.

How do I deduct a Gift Annuity to a charity. The IRS requires that the value of the annuity given to the donor must be less than 90 of the value of the gift the donor gives to the charity. This is the amount that should be reported on Form 8283 as a charitable deduction.

No matter what type of asset you donate to establish a charitable gift annuity the income you receive from the annuity will be treated as either a return of capital or be subject to. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity.

Life Income Plans University Of Maine Foundation

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Gifts That Provide Income Maine Organic Farmers And Gardeners